Thermonics Corporation

Thermonics Corporation

OEM Capital assisted inTEST Corporation and its wholly owned subsidiary, Temptronic Corporation in its acquisition of the business of Thermonics. This is the third acquisition that OEM Capital has advised Temptronic on. Previously, we assisted in its acquisition by inTEST Corporation and, prior to this, in the recapitalization of the Company to realize partial shareholder liquidity.

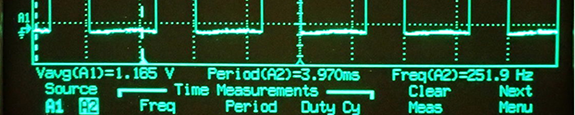

inTEST Corporation is an independent designer, manufacturer and marketer of temperature management products and ATE interface solutions, which are used by semiconductor manufacturers to perform final testing of integrated circuits (ICs) and wafers. The Company’s high-performance products are designed to enable semiconductor manufacturers to improve the speed, reliability, efficiency and profitability of IC test processes. inTEST’s Thermal Solutions Group provides customized temperature test solutions and offers the industry’s largest breadth of thermal solutions available. The group combines the strengths of Temptronic Corporation, the worldwide leader in temperature forcing systems for the semiconductor and broader electronic test market, and Sigma Systems Corporation, a provider of custom chambers and thermal platforms.

Established in 1976, Sunnyvale, California-based Thermonics is well established in the development of precision temperature testing systems and is a supplier of fast, accurate and reliable temperature-testing equipment. Thermonics’ products provide a range of precision temperature forcing systems used throughout a number of industries, including semiconductors, to verify the performance of products at a range of temperatures. Their systems are in use worldwide, providing high productivity and test accuracy as well as maintenance savings for their customers.

OEM Capital is a specialty investment banking firm offering corporate finance advisory services to both public and private electronics, communications, software, and information technology companies. Services offered include strategic advisory, mergers and acquisitions advisory, private placements of debt and equity, PIPEs, recapitalizations and restructurings, and financial opinions.

OEM Capital ‘s professionals have extensive experience in the industries they cover. As a founding member of the Alliance of International Corporate Advisors (AICA), OEM Capital provides its clients with access to transactions on a global scale, in every major technology market in the world.